Long term readers of this blog or those who follow my comments on other sites are probably aware that I'm skeptical of the conspiracies surrounding Germany's Gold repatriation. I wrote the following post mid last year:

Since then it's been revealed that only 5 tonnes of Germany's Gold has been delivered and the conspiracies have exploded in number again. When I see misinformation on the Gold blogosphere I will sometimes take time to correct the writer or provide an alternative perspective to their view. A recent occasion was on Koos Jansen's blog where I refuted (in the comments section) some of the conclusions he'd drawn (although on the whole I think his site is well worth reading). This led to an interesting discussion, which may not have changed the mind of any involved in the discussion, but it did provide a range of views for those reading the site.

Another site I've commented on a couple of times is that belonging to Dave Kranzler otherwise known as 'Dave in Denver' who writes at Investment Research

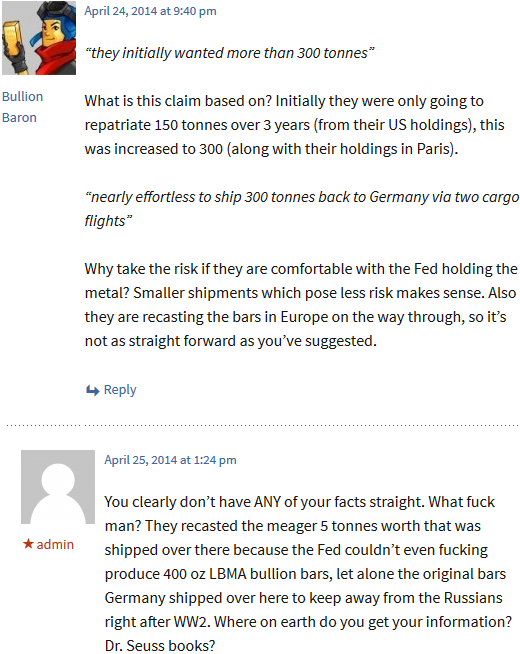

Dynamics (previously his blog was 'The Golden Truth'). He's written about German Gold repatriation on previous occasions and clearly has a different view to mine. A post of his a couple of days ago suggested that the German Gold repatriation request from the US Fed had initially been for a higher amount (than 300 tonnes). I questioned this in the comment section, following which he silently edited the post (which you can read here) and proceeded to reply to my comment with profanity and personal insults:

I won't stoop to the use of profanity or insults to get my view across, but will point out that my comment was factual, while Dave's post and follow up comment were riddled with inaccuracies.

The only real claim that I made was that Germany's Gold repatriation request was initially for 150 tonnes and later increased to 300. This FACT was confirmed in an interview with Carl-Ludwig Thiele (Member of the Executive Board of the Deutsche Bundesbank):

"We specified our initial target in October 2012. In January 2013, we then presented a new gold storage plan and specified a new target that is considerably higher than the first. Instead of only 150 tonnes, we are now transferring 300 tonnes of gold from New York to Germany."

Meanwhile Dave claimed that:

1. "They [Germany] initially wanted more than 300 tonnes [from the United States]". As per above this was silently edited from his post, so we shall assume that he changed his mind on this statement? Dave, please do provide the evidence for this claim or otherwise could you explain why you didn't address it's removal in your response to me?

2. Dave claims further that "it should have been nearly effortless to ship 300 tonnes back to Germany via two cargo flights". Now from a logistics perspective that may be so, but you need to take into consideration insurance (for which a Forbes contributor said a maximum 3-5 tonnes per flight would be possible), not to mention that 2013 was a particularly busy year for Gold refiners ("the capacity of smelters are just limited" wrote one German newspaper). So while it may have been technically feasible for Germany to ship the Gold in two cargo flights, it would have incurred unnecessary risk (in that the Gold would not have been insurable), not to mention making it particularly difficult to have the bars recast without a refinery able to safely store and process the Gold in a timely fashion.

3. In the follow up comment to me he suggests that the German Gold stored in the US originated from Germany: "let alone the original bars Germany shipped over here to keep away from the Russians right after WW2". The reality is that Germany's Gold holdings stored in the US have never been in Germany. From Carl-Ludwig Thiele in the interview previously linked:

"It is not a question of “returning”. The gold is being transferred to Germany for the first time. Until 1998, only 2% of our gold, or thereabouts, was stored in Germany. In the first year, we transported five tonnes from New York. This year, we will transfer 30 to 50 tonnes, or perhaps even more, from New York to Frankfurt. And there is still next year to come."

It's no secret that Germany's Gold in the US wasn't all in 'Good Delivery' form, this is the reason the bars are being refined in Europe during their transit to Germany. The United States built up an impressive Gold hoard, more than tripling their reserves between 1930 and 1940, as they hoovered it up from citizens following the 1933 Gold confiscation. It wouldn't be surprising if some of the Gold bars that Germany acquired in the United States over the 1950's and 1960's consisted of some 90% pure bars which were melted from the coin confiscation.

Anyway, the point here was to highlight that you shouldn't believe everything you read about Gold on the internet (I would even encourage you to double check my claims), especially in relation to German Gold repatriation (is this even the right word given the Gold didn't originate physically in Germany?). There is a lot of misinformation, factually inaccurate claims and emotive wording used by commentators in the precious metals space to try and draw readers to their point of view.