I continue to see articles that speculate the price decline in Gold this year (and concurrent drop in ETF/Comex holdings) is a direct result of Germany's request for a portion of their Gold reserves back from the United States (as they scramble to secure physical Gold to fulfill the request).

This image in particular caught my eye from a recent TTMYGH report:

The event alongside price activity and ETF holdings sure paints a compelling story. Surely we don't need any facts to support the narrative? Grant Williams says the following in the report:

Wanna know what I think, folks? I think the central banks have been leasing their gold out for decades to the bullion banks and now find themselves in the rather precarious position of needing to reclaim that which they are supposed to own before the shortfall is exposed. I think that creates a big problem for both sides of that little scheme.He later goes on to say:

Now, call me old-fashioned if you will; call me a conspiracy theorist, a goldbug, a wacko - whatever you like - but if you do, will you please give me an explanation as to why this gold is vanishing, where it is going, and who is taking delivery of it? Because, from where I stand, the evidence points to the beginning of the unraveling of the fractional gold lending market, and THAT spells trouble.In my opinion he answers the question about where the Gold is going in the text leading up to the question:

I also think that retail investors — particularly here in Asia — are, unfortunately, compounding the banks' problems by using the weakness in the paper markets to acquire as much physical metal (or, as it's known in this part of the world, "wealth") as they can.

Not that we can trace the movement of physical Gold to confirm that the metal flowing out of the Comex, GLD and other ETFs is heading to Asia, but I'd imagine some of it is (Shanghai Gold Exchange delivery vs world mining supply, via Koos Jansen):

As for where the rest is going, well it's certainly not 'vanishing' (except into the vaults of those who believe Gold is worth buying at these prices), but there is definitely a lack of transparency in the market which allows commentators to makeup their own narratives.

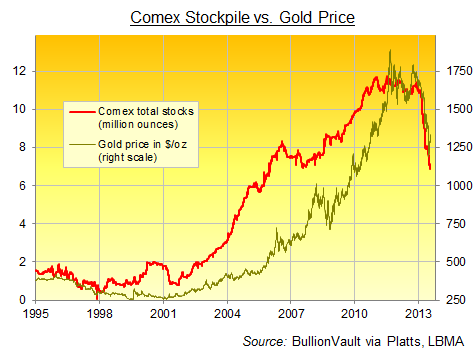

He provides no real evidence that suggests the price decline and ETF shakeout is the result of central bank leasing activity and in fact once we zoom out on the price / Comex stock chart (courtesy Bullion Vault), it looks quite natural that the inventory should fall with price, just as it increased as the price rose over 2001 to 2011:

To me the charts showing reduction in ETF / Comex holdings look like the capitulation of price speculators in the west after having battled on for the past two years of sideways/lower prices, finally throwing in the towel and selling their holdings (maybe even having been lured into the equities market which has recently appeared 'unstoppable'). The gold appears to be moving from the hands of price speculators in the west to the safes, vaults, necks and wrists of those in the east who understand Gold as wealth (and concerned with buying more at lower prices, rather than selling).

Of course my interpretation of the data can't be proven one way or the other either. I can't prove that the price rout is not a direct result of the bullion banks or central banks trying to shakeout metal from weak hands to cover their obligations after leasing the metal, but I will try and provide some context for my opinion that the repatriation request from Germany is not key to the recent price decline...

Something that I have voiced in the comments section on various sites, but not yet pointed out on my blog, is that I believe the rate at which they are repatriating the Gold from the US (the point of most speculation) was set by Bundesbank, not the Fed. The rate (circa 50 tonnes per annum over 7 years) is the same recommended by their court the previous year (for testing/examination of their Gold):

As for where the rest is going, well it's certainly not 'vanishing' (except into the vaults of those who believe Gold is worth buying at these prices), but there is definitely a lack of transparency in the market which allows commentators to makeup their own narratives.

He provides no real evidence that suggests the price decline and ETF shakeout is the result of central bank leasing activity and in fact once we zoom out on the price / Comex stock chart (courtesy Bullion Vault), it looks quite natural that the inventory should fall with price, just as it increased as the price rose over 2001 to 2011:

To me the charts showing reduction in ETF / Comex holdings look like the capitulation of price speculators in the west after having battled on for the past two years of sideways/lower prices, finally throwing in the towel and selling their holdings (maybe even having been lured into the equities market which has recently appeared 'unstoppable'). The gold appears to be moving from the hands of price speculators in the west to the safes, vaults, necks and wrists of those in the east who understand Gold as wealth (and concerned with buying more at lower prices, rather than selling).

Of course my interpretation of the data can't be proven one way or the other either. I can't prove that the price rout is not a direct result of the bullion banks or central banks trying to shakeout metal from weak hands to cover their obligations after leasing the metal, but I will try and provide some context for my opinion that the repatriation request from Germany is not key to the recent price decline...

Something that I have voiced in the comments section on various sites, but not yet pointed out on my blog, is that I believe the rate at which they are repatriating the Gold from the US (the point of most speculation) was set by Bundesbank, not the Fed. The rate (circa 50 tonnes per annum over 7 years) is the same recommended by their court the previous year (for testing/examination of their Gold):

The Court had determined the order of the Bundestag that the Bundesbank their gold reserves stored abroad scrutinized. It is disputed whether the years experienced by the Bundesbank practice sufficient to rely only on a written confirmation to the gold bullion by foreign central banks.

The Court therefore recommends that the Bundesbank to negotiate with the three foreign banks have a right to physical examination of the stocks. With the implementation of this recommendation, the Bundesbank has begun according to the report. They also decided to bring in the next three years of 50 tons each lying at the Fed in New York, gold for Germany in order to undergo a detailed examination here. Spiegel

Presumably this rate of delivery was fixed at 50 tonnes for logistics purposes, this post from Silver Stackers forum member Big A.D. is worth considering (note that the figures include the Gold being repatriated from the US and Paris combined):

Based on my speculation that it was the Bundesbank and not the Fed that had set the delivery rate, I posed the following questions to Bundesbank via email:

Has anyone considered the logistics of actually counting out, transporting, counting in and then testing 674 tonnes of gold?

Assuming deliveries are evenly spread out, they'll be shifting 1.85 tonnes each and every week for seven years. If the gold is in the form of 400oz LBMA spec bars, each shipment will contain 148 bars.

At current prices, each weekly shipment will be worth about $100 million in assets which are completely untraceable after being melted down. That is an incredibly tempting target for anyone looking to acquire a large amount of gold without paying for it. It's the kind of target that attracts professionals with military training and experience in special operations.

Whoever is doing the transporting might well be uncomfortable moving more than $100 million at a time, or rushing delivery to the point where there is a very noticeable stream of armoured cars driving out of the Fed's vaults every day for months at a time. Whoever is insuring the shipments might feel similarly uncomfortable at the prospect of paying out to replace a lost delivery and wants to spread their risk out. The bigger the shipments, the more concentrated the risk.

Then there is the testing that has to occur at the German end (because checking the gold is all there is half the reason for the exercise to begin with). These are allocated bars (i.e. with serial numbers) and they're Germans so they'll measure it down to the gram.

Assay and (re)manufacture takes time and effort and a lot of expertise which will probably be contracted out and whoever is doing it will basically be melting down ~150 x 400oz bars each and every week for 7 years, or roughly 30 per working day, or roughly one every 15 minutes. All of them has to be checked, perhaps individually, so that if any tungsten is found - or more likely just some regular, boring impurities - it can be traced bar to an individual bar and that bar's history can be investigated to find out when and where it entered the system and who owes who the difference in weight.

At current values, the gold in question is worth about $37 billion dollars. We're used to seeing that sort of figure tossed around in discussions about global finance but it's worth remembering that this isn't just fake 1s and 0s money, this is actual, physical real money and there are practical issues in handling it which is why people tend to just leave it sitting in vaults to begin with.

There is a lot of speculation about the slow delivery of Gold from the United States to Germany (300 tonnes being repatriated), are you able to advise whether the rate of transfer (approximately 50 tonnes per year) was requested by Bundesbank or whether the Federal Reserve limited the amount that could be withdrawn each year (i.e. who set the transfer rate)?

Their response (which was really just a cut and paste response from previous communications and press releases):

Thank you for your enquiry.Unfortunately their response didn't directly answer the question regarding who set the rate of delivery, but I did follow up with another question:

The Deutsche Bundesbank keeps a part of its gold holdings in its own vaults in Germany, while some of its gold is also stored with the central banks located at major gold trading centres. This has historical and market-related reasons, the gold having been transferred to the Bundesbank at these trading centres. Moreover, the Bundesbank needs to hold gold at the various trading centres in order to conduct its gold activities. It is common practice for central banks to keep part of their gold reserves abroad.

Besides the Deutsche Bundesbank, other central banks and official agencies place gold in the custody of foreign central banks. According to its own data, the Federal Reserve of New York holds gold stocks for almost 60 different central banks and official agencies.

The Deutsche Bundesbank can withdraw gold from its holdings with foreign central banks at any time.The Bundesbank's gold is stored in the form of individually identifiable bars. Gold stocks are subjected to regular audits. Relevant inventory controls are conducted on site.

The Bundesbank applies the principles of safety, cost efficiency and liquidity to the management of foreign reserves in general, and to that of gold reserves (and, in this context, to the question of custody location in particular). As a rule, the physical transfer of gold reserves to another storage location cannot be ruled out.

Deutsche Bundesbank’s new storage plan for Germany’s gold reserves:

By 2020, the Bundesbank intends to store half of Germany’s gold reserves in its own vaults in Germany. The other half will remain in storage at its partner central banks in New York and London. With this new storage plan, the Bundesbank is focusing on the two primary functions of the gold reserves: to build trust and confidence domestically, and the ability to exchange gold for foreign currencies at gold trading centres abroad within a short space of time.

The following table shows the current and the envisaged future allocation of Germany’s gold reserves across the various storage locations:

To this end, the Bundesbank is planning a phased relocation of 300 tonnes of gold from New York to Frankfurt as well as an additional 374 tonnes from Paris to Frankfurt by 2020.

On safety grounds we cannot publish details about the repatriation.

Thank you for the detailed reply, I have a follow up question. As is clear from the below email, Germany's physical gold bars are identifiable and audited, is there any circumstances under which the Federal Reserve could hold Germany's physical gold but lease the same gold bars into the market? Is there any way the bars could otherwise be encumbered by another party?

Which received the following response:

Many thanks for your enquiry.While my questions didn't stem directly from the article to which they referred, I did check up on the article mentioned and appears to be this one from King World News where hedge fund manager William Kaye claims that (leased) central bank gold has been sold into the market and melted down:

Your question might refer to a recent internet blog on "missing Fed and German gold" (July 2013).

Please consider that this source is not reliable and that the hedge fund manager statements quoted are not truthful.

The Bundesbank has full control over its gold reserves.

Please find below further information on the Bundesbank's gold reserves:

http://www.bundesbank.de/Redaktion/EN/Pressemitteilungen/BBK/2012/2012_10_22_gold.html

http://www.bundesbank.de/Redaktion/EN/Pressemitteilungen/BBK/2013/2013_01_16_storage_plan_gold_reserve.html

Once JP Morgan and Goldman Sachs get the gold they sell it into the market. So these bullion banks then become net-short gold. And the Fed says, ‘Well, we still have a contract where in theory we can claim the gold. So we’re going to report that we still own it in the official documents.’Kaye concludes with the wildly speculative conclusion that Germany will never receive their Gold back because it no longer exists at the Fed. Yet another story teller taking snippets of information from various sources and adding their own twist. It seems highly unlikely that the Fed or any other central bank would breach the trust of other friendly countries by leasing out their Gold.

So in summary:

- The repatriation rate of 50 tonnes per year is a continuation of arrangement organised in late 2012 (indicating Bundesbank requested this rate, not a limit set by the Fed).

- The logistics of transporting, testing and perhaps recasting the bars will be significant.

- Bundesbank is retaining a large portion (37%) of their Gold reserves with the Fed indicating a strong level of trust.

- Bundesbank says their Gold is allocated with identifiable bars and can be withdrawn at any time.

- Bundesbank refutes the stories of KWN that their metal is leased and not at the Fed.

At the end of the day I have to side with the official story, because other narratives lack the support of more conclusive evidence.

It doesn't take much to get the precious metals rumour mill pumping out propaganda these days, for example the Bank of England recently released an internet and mobile based tour of their Gold vault facility which had text mentioning "over 400,000 gold bars" in the vaults. This ended up being roughly 1300 tonnes short of the audited figure reported earlier in the year, which some concluded meant that it was leased or sold into the market to cause the price decline...

GoldMoney's Alasdair Macleod says that the Bank of England recently become a prolific supplier of gold – leasing out 1,300 tonnes of the yellow metal in just four months.

In an interview with the Keiser Report on the Russia Today network, the GoldMoney research director told financial pundit Max Keiser what he thinks happened to 100,000 gold bars.

While perusing the BofE's new website application, which allows you to take a virtual tour of the Kingdom's gold vaults, Macleod learned that in June the bank was holding 400,000, 400-ounce gold bars.

As a veteran precious metals adviser, Macleod noticed a discrepancy between this figure and the Bank's year-end accounting from February which reported 505,000 bars in storage. Mining.com

Thankfully there are sites out there looking for such outrageous claims and the above story was thoroughly debunked by Warren at Screwtape Files (a report which is well worth reading in full).

A point I've seen made elsewhere about the German Gold repatriation story is what would have transpired if Germany had decided to pull the 300 tonnes (or even all of their Gold) out of the US in 2 weeks instead of 7 years? No doubt there would have been articles all over the web claiming Germany is making a rush for the exit with their Gold... there will always be sites and commentators ready to peddle sensational stories, it's up to the individual to decide which ones are plausible and which ones aren't. Perhaps the day will come that the "paper gold" market breaks down and all the Gold markets dirty secrets are revealed (I have no doubt there are some), validating some of the stories that circulate on the internet... that would only ever be the icing on the cake as far as I'm concerned, there are already plenty of reasons to own physical Gold without the need to believe tall tales.

You can follow me on Twitter. I'm usually sharing links and opinions daily (@BullionBaron). You can also CLICK HERE to signup for free email updates.

BB.