"When all the inspections had been concluded, no irregularities came to light with regard to the authenticity, fineness and weight of the bars."

- Bundesbank

Big news from Bundesbank released only minutes ago... they've repatriated 120 tonnes of Gold in 2014 with 85 tonnes coming from New York and 35 tonnes from Paris. Conspiracy theorists eat your heart out!

Bundesbank confirmed the repatriation is proceeding smoothly, that operations are running to schedule and that there were no irregularities with the Gold delivered. Furthermore, 50 tonnes of the Gold from New York was melted down and recast into London Good Delivery standard bars.

As I've covered this topic so extensively in the past this won't be a long post (and is likely to be covered in more detail by Koos Jansen on his blog in a short while).

As I've covered this topic so extensively in the past this won't be a long post (and is likely to be covered in more detail by Koos Jansen on his blog in a short while).

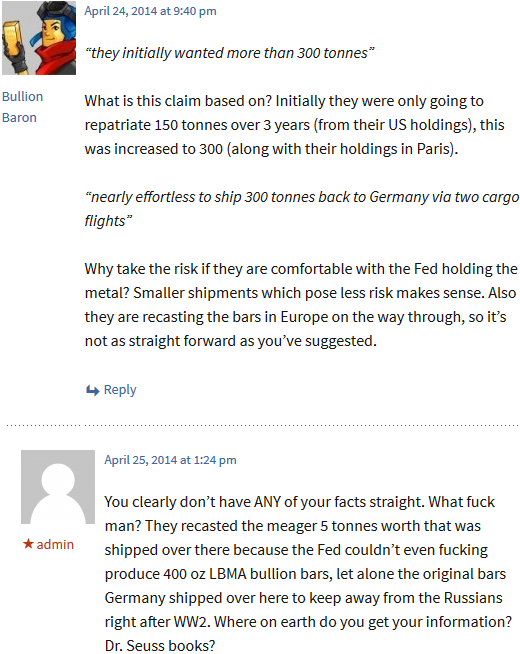

Since announcing the repatriation skeptics have been coming up with any and every conspiracy theory they can dream of in relation to Germany's Gold and why they decided to shift it so slowly (674 tonnes over 7 years) and why only 5 tonnes were moved over 2013 from New York. Here is my coverage of the topic to date:

After Zero Hedge misinterpreted the Bloomberg article (see last link of above 3) on Germany's Gold repatriation, they implied there was a change to the schedule (i.e. that they'd stopped)... a narrative that they've continued propagandising over several articles:

Zero Hedge on 23/06/2014 - "Germany appears to have given up entirely in its attempt to recover gold which simply is not there..."Zero Hedge on 16/11/2014 - "Germany was pressured to keep its gold in the US after a "diplomatic" line of communication was opened, most likely the result of the Fed making it all too clear clear to the Bundesbank not only who runs the show, but what the assured failure to repatriate Germany's gold would mean for "price stability." Which has, for now at least, ended Germany's gold repatriation demands."Zero Hedge on 21/11/2014 - "Well, today we know the answer: it wasn't Germany who was secretly withdrawing gold from the NYFed contrary to what it had publicly disclosed. It was the Netherlands."Zero Hedge on 29/11/2014 - "...it is now abundantly clear that the "logistical complications" excuse used by Germany to halt its own gold repatriation program was nothing but a lie to cover up what, as Deutsche Bank explained earlier this month, was an escalation of "diplomatic difficulties" between the US and Germany, one in which Germany has folded, if only for now."

After it was finally revealed in late 2014 that Netherlands wasn't responsible for the entirety of Gold withdrawals from the FRBNY, they were finally willing to admit there was some small sliver of hope that Germany's Gold repatriation might be ongoing:

Zero Hedge on 30/12/2014 - "The question is who: is it now the turn of Austria to reveal in a few weeks that it too, secretly, withdrew some 40+ tons of gold from "safe keeping" in the US? Or was it Belgium? Or did the Dutch simply decide to haul back some more. Or did Germany finally get over its "logistical complications" which prevented it from transporting more than just a laughable 5 tons in 2013? And most importantly, did Germany finally grow a pair and decide not to let "diplomatic difficulties" stand between it and its gold?"

While I'm a daily reader of Zero Hedge, they are a great aggregator of various content and are ahead of the curve on some news events and finance themes, their Gold narratives leave something to be desired. How will they admit they were wrong about the German Gold repatriation over the last 6 months? Probably with a heavy dose of spin and cynicism that Bundesbank is being truthful about the large and unexpected tonnage repatriated from New York.

Beware of sensationalist Gold market commentary. Looks like Germany's Gold repatriation is alive and well and will likely be completed by 2020 as I expected it would be.

---

I'm sharing links and opinions daily on Twitter (@BullionBaron).