Early in 2014 I lodged a Freedom of Information (FOI) Request with the Reserve Bank of Australia (RBA) to release the list of Gold bars that make up Australia's official reserves. After initial rejection, an appeal with The Office of the Australian Information Commissioner resulted in the RBA providing the list (melter/assayer, gross weight, assay and fine weight), but without revealing the serial numbers.

With 99.9% of Australia's Gold reserves being stored with the Bank of England (BoE) it pleased me to see that in 2014 the RBA had performed an audit on Australia's Gold reserves. I wrote another FOI Request to gather more information on the audit as the single line of text in the Annual Report was lacking in detail, "During the year in review, the Bank audited its gold holdings, including that portion held in safe custody at the Bank of England."

The result of the second FOI Request was a small cache of emails including communications with the BoE prior to the audit.

Something I had read, but overlooked the importance of, when the Gold bar list was originally provided was the difference between the BoE's bar number and the refiner bar number (I'd initially assumed that they were one and the same).

"The only information we will withhold from release are the individual bar numbers, as this information remains confidential (in the opinion of both the Bank of England and the Reserve Bank of Australia). The Bank of England (as our custodian) use their own numbering system to uniquely identify each bar and have reaffirmed to us that these numbers should not be disclosed to third parties as the information is confidential." RBA

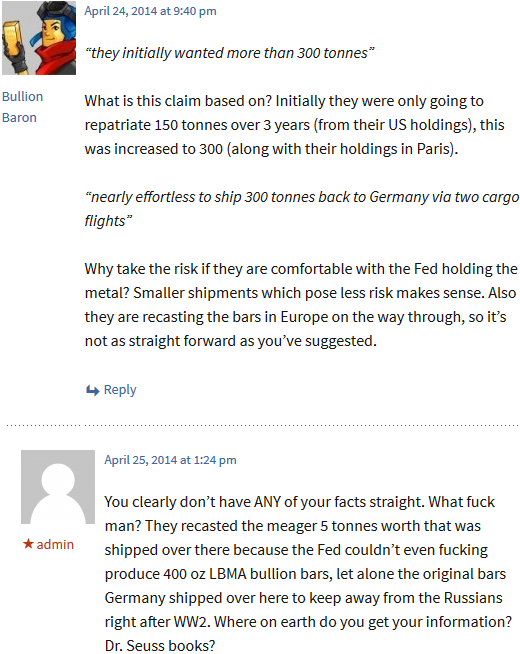

Though an anonymous comment on my post had picked up on the difference.

"What a joke from BoE and RBA re serial numbers. Each bar has it own number from the refiner, that is what should have been disclosed and could have without any confidentiality breach. The BoE special internal numbers did not have to be disclosed and are useless anyway in terms of ensuring the validity of the bar list.

Is the RBA saying that it and the BoE do not know the refiner bar numbers or have never recorded it? I find that hard to believe and if true is damning on their vault management."

Warren James at Screwtape Files followed up with an article on the emails from the audit. Amongst the humour (audio conversation between the RBA & BoE is a must listen) he highlights that the email communication mentions the BoE number.

"Each bar is marked with a unique BoE number" Maybe that was what BoE & RBA got confused with and why they didn't supply the serial numbers. If that were the case then the mixup would be gross incompetence in the whole matter. Definitely the BoE should not disclose their own internal tracking number since it would reveal detail about how the bank functions.

To clarify there was a difference between the two numbers (and if so to question why the refiner number couldn't be released) I wrote to the RBA again. If the BoE catalogues and tracks their Gold bars using an internal number, then what legitimate reason does the RBA have for withholding the refiner bar number following the original FOI Request? I received a response to my questions last week (questions in bold, RBA response in italics):

Is the unique Bank of England bar number different to the refiner bar number? It is our understanding that the Bank of England bar numbers are different to any markings that are placed on bars by the bar manufacturers. All bar lists relating to the RBA’s gold holdings show only one serial number per bar, the BoE serial number.

If so, why was the refiner bar number withheld from publication (oversight, on purpose or not present on the bar list)? N/A, for the reason detailed in answer to question 1.

If so and the refiner bar number is not used internally by the BoE (as a unique identifier, which their internal bar number acts as), can these be released as an extension of RBAFOI-131418 or would I need to submit a new request? This question is based on the assumption that there are two unique numbers on each bar, being the Bank of England bar number and a ‘refiner bar number’. As noted above, all documentation provided to the RBA has only one unique serial number per bar, which we understand to be the Bank of England’s own numbering system.

When I discussed the above response with Warren James via email he suggested that it could be seen as the BoE intentionally withholding key information. I disagreed at the time, pointing out that there are benefits to having a unique BoE number such as no chance of duplicating serial numbers (something Warren highlighted occurs with some refiners restarting a number sequence) and providing multiple bar numbers may result in confusion or errors. At my request Warren provided some interesting stats from his bullion bars database indicating that for 248,063 Gold bars, there was only 206,403 unique serial numbers, so it can be estimated that roughly one in five bars could share a serial number with another. In my eyes this highlights the need for a BoE internal number that can be unique to each bar they manage, but Warren wrote further:

"The serial number is specifically named by LBMA as one of the marks required to be London Good Delivery, so I had always counted it as part of the 'standard' - at least it has been since year 2000 (ref. p44 of 'The London Good Delivery List, building a global brand 1750-2010 by Timothy Green').. it's just one of those key bits of metadata which cannot not be casually discounted.

From a data design perspective ...

•Even for their own internal systems they would still be capturing every marking on the bar, and for most London Good Delivery bars it will be there.

•Bar Serial number is definitely stored in their database (or spreadsheet?), because it's a part of the LGD System they would need it on their inter-transfers.

•In terms of data extraction, it's a trivial matter to include an extra column of data.

•They weren't just culling redundant information > otherwise it is possible to remove GrossWeight or FineWeight, since Assay can be used to determine one or the other.

The absence of the serial number is deliberate, the only question is why? There shouldn't be an issue if it is actually allocated.

I think the BoE just decided they didn't want the detail out in the wild, because it allows the bars to be traced with high accuracy."

In a comment on Screwtape Files he concludes:

"So the industry standard for LBMA good delivery is Serial+Refiner+Weight+Assay, and the BoE leave out the serial number. Not only that, but the RBA don't question the omission. Without that key bit of differentiating information it isn't possible to track or trace the bars in any meaningful way. This appears to be the intent of BoE.

Definitely they store the information > Serial Number is always present in any other industry 'weight list'. Makes you wonder about the quality of the audit which was conducted - open for abuse since the key information is controlled by Bank Of England."

I think Warren raises some solid points and after giving it further thought I do agree that the refiner bar number should be provided to the RBA (and any other central bank or party that the BoE is custodian for) and don't see why it shouldn't also be available to the public given that it differs to the unique internal number that BoE uses to identify and manage each of the bars they store.

It does cast doubt on the veracity of the RBA's audit of Australia's Gold. Can you think of any other audit scenario where an internal reference number is accepted (by an external auditor) in place of the manufacturers own (which doesn't get checked at all)? One might hope that if they take the opportunity to audit Australia's Gold again (something they were invited to do), that they do so more thoroughly. I think the likelihood of them finding a discrepancy (such as a missing bar) is slim, but a half-baked audit negates the rationale for performing one in the first place.

---

I'm sharing links and opinions daily on Twitter (@BullionBaron).

BB.