Update: Since I posted the below Michael Krieger has updated his blog post to confirm the repatriation schedule is unchanged. Zero Hedge also posted a follow up article. Both point to the Bloomberg article as being misleading, which I agree with (particularly the title), but still think that anyone reading the article in it's entirety (and is familiar with the German repatriation story) should have picked up that there was no plans to change the repatriation of 300 tonnes from the NY Fed.

---------------------------------------------------------

Today Zero Hedge is headlining an article by Mike Krieger suggesting that Germany will stop repatriating their Gold: Germany Gives Up On Trying To Repatriate Its Gold, Will Leave It In The Fed's "Safe Hands".

---------------------------------------------------------

Today Zero Hedge is headlining an article by Mike Krieger suggesting that Germany will stop repatriating their Gold: Germany Gives Up On Trying To Repatriate Its Gold, Will Leave It In The Fed's "Safe Hands".

Unfortunately this is misinformation and they have both either misunderstood or are purposefully misreporting what the Bloomberg article they reference is actually saying.

They are not the first to get it wrong on the German repatriation story, it seems to be common as I have covered previously:

Here is an excerpt from the Zero Hedge article which includes part of Krieger's piece:

Several months after it was revealed that Germany was able to only recover a miserable 5 tons of its gold in all of 2013 (under 10% of the 84 tons it was scheduled to repatriate), Germany appears to have given up entirely in its attempt to recover gold which simply is not there, and as Michael Krieger reports, citing Bloomberg, has decided to keep "it" (by "it" we don't mean the gold since that clearly has not been at the Fed for decades, but merely the paper promises of ownership: for more see China's gold rehypothecation scandal and how the unwind works) at the NY Fed after all. That is to say, in the "safe hands" of former Goldmanite Bill Dudley.

Via Mike Krieger's Liberty Blitzkrieg blog,

Just last week, I published a post titled, Video of the Day – “End the Fed” Rallies are Exploding Throughout Germany, which subsequently went viral. Interestingly, only a few days later we find out that Germany’s very own criminal political class has decided it will continue to store the nation’s gold in New York rather than bring it back home as had been the intention. It’s quite ironic that just as protests against the fascist Federal Reserve are spreading throughout the land, the political class officially decides to keep Germany’s treasure across the Atlantic, in care of none other than The Fed itself.

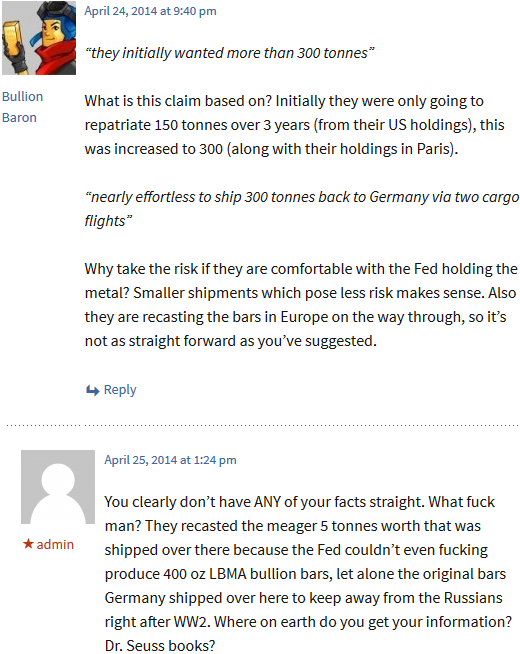

Both Zero Hedge and Krieger imply there has been a change to the repatriation schedule, but the truth of the matter is that the Bloomberg article only refers to stopping earlier attempts to bring home all of Germany's Gold:

Surging mistrust of the euro during Europe’s debt crisis fed a campaign to bring Germany’s entire $141 billion gold reserve home from New York and London. Now, after politics shifted in Chancellor Angela Merkel’s coalition, the government has concluded that stashing half its bullion abroad is prudent after all...

...“Right now, our campaign is on hold,” Peter Boehringer, a Munich-based euro critics who co-founded an initiative to bring home all of Germany’s gold in 2012, said in an interview.

And there has been NO CHANGE to the repatriation schedule of 300 tonnes from New York & 374 from Paris which will ultimately result in 50% of Germany's Gold being stored at home. This is the schedule that was published by Bundesbank last year.

|

| Germany's Gold Repatriation Schedule |

It was confirmed in today's article from Bloomberg that there is no intention to change the schedule:

The central bank met the critics halfway. Last year, it began moving the Paris gold to Frankfurt, pointing out that Germany and France now have the same currency, the euro. Enough of the gold in New York and London will be brought home so half the reserves will be in Germany by 2020.

No doubt there will still be plenty of commentators in the precious metals space continuing to twist the story as they see fit, especially so if Bundesbank remains behind schedule when they publish an update later this year or early next, but in my opinion:

- The NY Fed has the physical Gold

- The repatriation will complete on or near schedule by 2020 &

- There is no conspiracy (missing or leased Gold)